Lea Uradu, J.D. is actually an effective Maryland State Registered Tax Preparer, County Formal Notary Societal, Specialized VITA Tax Preparer, Internal revenue service Annual Submitting Seasons System Participant, and you can Tax Blogger.

Before the Taxation Incisions and Services Operate (TCJA) away from 2017, homeowners you will definitely allege various more income tax deductions. But these are not any longer an alternative. Adopting the TCJA turned into law, its much harder to acquire a beneficial deduction when you borrow against your home’s equity-however it is nevertheless you’ll be able to for individuals who meet particular requirements.

Trick Takeaways

- Focus paid down towards the property guarantee mortgage or a home guarantee personal line of credit (HELOC) can still be tax deductible.

- Try not to sign up for a house security loan or an effective HELOC merely towards the taxation deduction.

- The newest high standard deduction means even people who normally claim a house collateral income tax deduction may not find it beneficial to do so.

Sorts of Family Security

There are two main ways you might borrow secured on the residence’s equity. You could sign up for both property collateral loan otherwise a good domestic collateral line of credit (HELOC). One another allows you to borrow against the newest collateral you have of your house, generally speaking to have far lower interest rates than many other unsecured kinds of financial obligation.

Deciding among them relies on your current condition, particularly the amount of money you need over what time. One another a property collateral loan and you will an excellent HELOC bring the same danger of foreclosure if you cannot outlay cash straight back, or of going underwater in the event the residence’s worth decreases notably. Each other home collateral money and you will HELOCs have the same guidelines into the domestic collateral income tax deductions.

Certain Income tax Rules

Only the attract toward home security loan or the HELOC could be subtracted, also it is employed to help you get, create, or significantly boost the taxpayer’s family one obtains the Shoal Creek loans loan.

The inner Funds Solution does not explicitly state how much does and you can will not matter below get, build, or substantially boost. While being unsure of should your costs often matter, keep your receipts and you may speak with a tax preparer getting certain pointers.

And restricting the fresh deduction to particular expenses, the attention deduction is just readily available for an entire loan amount regarding $750,000. Thus if you’re claiming the borrowed funds notice deduction both for your primary mortgage along with your home guarantee mortgage or HELOC, you might merely claim desire towards doing $750,000 out-of combined loan balances.

Lowering your Taxation Load

Leveraging their house’s collateral for just the fresh sake from reducing your fees may possibly not be an informed monetary possibilities. The brand new high quality deduction means that you will possibly not enjoys taxation deals, and also if you do, you will be using money into the bank to prevent purchasing an identical sum of money so you’re able to The government-and you will eroding the house’s security in the process.

Itemizing versus. the quality Deduction

And additionally restricting stating the borrowed funds attract deduction, the latest TCJA considerably boosted the basic deduction. Inside the 2022, the quality deduction was $a dozen,950 having solitary filers and married people filing by themselves otherwise $twenty five,900 for married couples submitting as one, ascending so you’re able to $13,850 to have solitary filers and you can $twenty seven,700 to possess people in 2023.

Consequently for these filers not already itemizing, until he’s got an especially large interest and you will financing stability, using simple deduction may result in the best refund. Of these already itemizing to other grounds, including for the family equity taxation write-offs decrease their tax bill.

Property guarantee credit line (HELOC) and you can a house equity mortgage each other utilize the security you have of your house because the collateral. A HELOC is actually a line of credit which allows that purchase, or perhaps not invest, doing their limit as needed and reduce through the years. Property guarantee loan are financing to possess a set lump contribution which you make repaired interest rate costs towards over a good given time period.

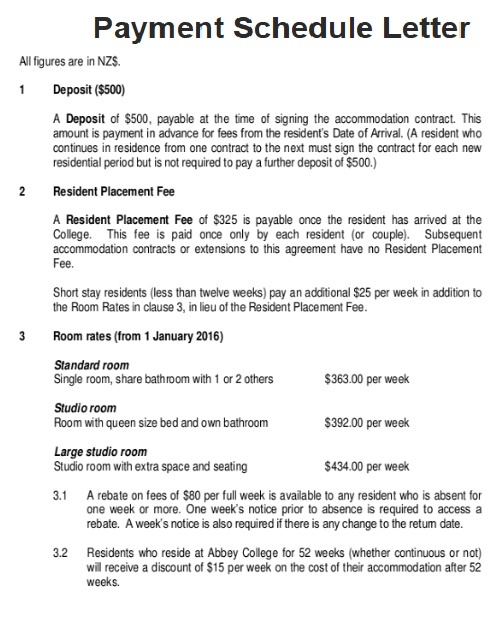

Just how much security would you like to own a property security financing otherwise a HELOC?

Personal requirements differ among loan providers, however you will you prefer no less than 75% collateral of your property to own an effective HELOC. Very loan providers require at least 80% guarantee getting a house security mortgage.

How to calculate brand new guarantee in my home?

So you’re able to determine the new percentage of security you have on the domestic, subtract the current balance toward one funds that you have into the your residence regarding the most recent projected value of your property. 2nd, split that profile by value of your home.

The bottom line

Brand-new income tax statutes nonetheless allows you to allege a home security tax deduction on notice repaid in your HELOC otherwise home equity financing as long as you’re with the money purchasing, generate, otherwise significantly boost the assets that the HELOC otherwise domestic collateral loan will be based upon. Into enhanced standard deduction, you may not end stating the interest paid for the fresh home security taxation deduction unless you are planning itemize your own come back.