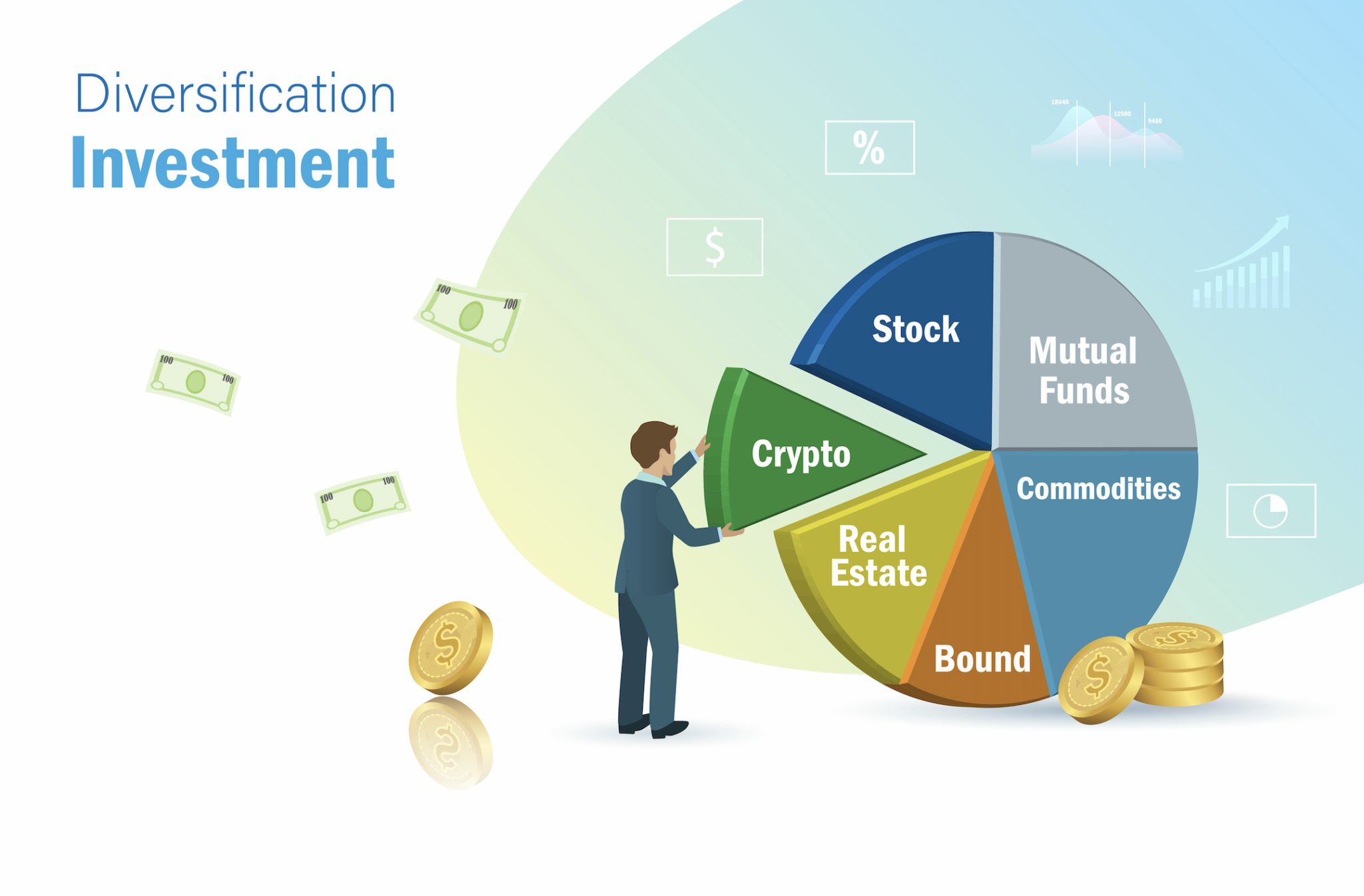

Including, you can get an economic otherwise funding advisor otherwise have fun with an excellent robo-coach to design and implement a financial investment approach in your stead. Dependent within the 1993, The fresh Motley Deceive is actually an economic functions organization seriously interested in and make the world smarter, delighted, and you can richer. Variation includes many investments, such carries, ties, otherwise home, inside a collection to minimize portfolio chance. All of the investments have some amount of risk and also the marketplace is unstable, it moves along throughout the years. It is necessary on how to learn your risk tolerance.

It’s a vital foundation of your own rate-to-guide proportion, because of it appearing the genuine commission for concrete assets and you can maybe not more difficult valuation from intangibles. Consequently, the newest P/B would be thought a relatively traditional metric. In early 1900s, people of holds, bonds, or any other ties have been revealed inside the mass media, academia, and you may commerce because the speculators. Within the finance, the goal of spending should be to make an income to your spent resource. The fresh come back get consist of a money get (profit) otherwise loss, realized if the financing is available, unrealised money love (or decline) in the event the but really unsold.

Which type of funding do you want to know more about?

A common money is a kind of investment in which https://cpa-partners.top/posts/creative more than you to definitely investor pools their funds along with her to find bonds. Shared money are not always inactive, since they’re managed because of the collection executives just who spend some and you will distribute the brand new pooled money to the holds, securities, or other bonds. Really shared financing has the very least funding from between $five hundred and you may $5,100, and some lack any lowest whatsoever. Also a relatively small financing brings connection with possibly 100 additional holds contained in this a given fund’s collection. There are even shared money you to dedicate exclusively inside the companies that conform to specific ethical otherwise ecological prices (aka socially in control fund). For their secured, fixed cost from return, securities are also also known as fixed-income investments and are less risky than just carries.

We do not range from the universe out of organizations or monetary now offers which is often available to choose from. Also referred to as wise paying, it is a technique that requires close business analysis and desire to the present situations to determine what carries may be undervalued. Tend to compared to offer-query – getting a set of boots that have an enthusiastic 80% disregard. The key benefits and you will great things about ETFs try diversity, straight down will set you back, the choice to find far more choice investments, and it is in addition to a lot more income tax successful.

Particularly, common financing otherwise ETFs are a good first step, ahead of moving forward to private holds, a property, and other alternative assets. Containers of investment including common fund and you can ETFs can help build investment allocation and you will diversity simpler as they come with a made-inside the mix of assets currently. You could potentially mix various diversified financing to find the total mix you would like—although easiest solution could be to choose an individual money which is aligned to the requirements, strategy, otherwise objectives. Money organization such as Fidelity helps you mode a trading and investing means or take control of your investment to you personally.

Investment tips

Do you need considerably more details now you understand spending principles and also have some money to spend? How you can invest utilizes yours choices and you may economic things. There’s a whole style of Tv shows making it are available as if to find and you can flipping a house ‘s the progressive equivalent away from alchemy. You might imagine we have all the amazing capability to change drywall and you can plastic material siding on the silver. People who pick property looking to get steeped brief should comprehend the dangers. Paying small amounts of cash is an excellent habit discover on the as well as your currency could add up-over time.

To fully capture the full suits because situation, you would need to lead 6% of one’s paycheck yearly. We are going to go over the individuals professionals in more detail lower than, along with four most other investment alternatives. Financing banking institutions suggest additional subscribers in one office and you will exchange their own membership in another.

Ideas on how to Invest Money: A step-by-Step Book

Shared finance offer investors an affordable way to diversify — spread their money around the several investments — to help you hedge up against any single financing’s losings. Building an excellent varied portfolio out of private holds and you will securities will take time and you can options, therefore very investors make the most of money using. Directory finance and ETFs are generally reduced-costs and simple to deal with, as it might bring simply four to five fund to build sufficient diversification. There are a lot of financing business that enable your to expend your finances inside market recording directory ETFs.

Begin Investing Very early, Continue Investing Frequently

- Consequently if one solitary business endures a large problem, it acquired’t drown your entire profile.

- You will possibly not manage to purchase a living-promoting property, but you can purchase a family you to really does.

- Because of this, inventory investing requires a fair amount of search, lingering diligence and you will an abdominal to possess exposure.

One display pricing is essentially the ETF’s money minimum, and depending on the financing, it does cover anything from less than $100 to $3 hundred or even more. An industry list are various opportunities one to depict a great portion of the industry. Such, the fresh S&P 500 are a market index one to keeps the newest holds out of around five hundred of one’s largest businesses from the You.S. A keen S&P five hundred directory financing perform make an effort to mirror the new efficiency of the brand new S&P five hundred, buying the brings for the reason that directory.

When you have years and you may ages before you could you need your money, you’re generally within the a much better reputation to come out of dips inside the disregard the value. Deciding simply how much risk to consider when paying is known as evaluating their risk endurance. For many who’re confident with far more brief-name good and the bad on your own money value on the options away from better enough time-identity productivity, you actually have greater risk threshold. At the same time, you could feel better which have a slow, much more reasonable speed away from return, having a lot fewer ups and downs. To shop for “physical” merchandise function holding quantities of oils, grain and silver. Because you may think, this is simply not how a lot of people spend money on merchandise.

The brand new questionnaire months concluded a few days before Given’s final Federal Open-market Panel fulfilling of the season, where it signaled a slow pace away from rate slices inside the 2025. Dollar-prices averaging (DCA) is yet another chief money approach you to definitely basically concerns splitting the new swelling sum of money invested in you to team inventory to the a small amount over a period of go out. In contrast, some get pick couch potato committing to repaired-money securities to generate more enough time-label couch potato income but wanted reduced ongoing interest.