Need more

- Alt lenders’ ability to power technical and provide better financing functions toward underserved is permitting them to penetrate the marketplace and find achievement.

- Insider Cleverness keeps divided exactly what choice financing is, record the top alt loan providers in the business, and you can outline just how choice financial institutions was threatening the newest popularity of incumbent banking companies.

- Can you work in the latest Banking business? Score company insights into the latest technology innovations, sector style, as well as your competition which have analysis-inspired search.

https://paydayloancolorado.net/edgewater/

Nonbanks and you will option financing institutions make their way with the financial industry posing a primary possibilities so you can incumbent banking institutions. Alt lenders’ capability to use tech and gives effective and effective financing functions to help you underserved companies and individuals was allowing them to infiltrate the market industry and find achievement.

Less than i break apart exactly what alternative financing is actually, listing the big alt lenders in the business, and detail how alternative loan providers was intimidating the brand new popularity out of incumbent banking companies.

Nonbank real estate loan

Considering the controls out-of mortgage loans, it may be problematic for incumbents so you can digitize the fresh new financing techniques, and inability regarding old-fashioned banks to help you adapt to the fresh new digital land have end in a rise in alt lenders providing mortgage funds so you can people.

Insider Intelligence’s On the web Mortgage Financing Statement found that the top four All of us banking companies Wells Fargo, Financial off America, and you can JPMorgan Pursue, Us Bancorp, and you may Citigroup only taken into account 21% from complete financial originations, that’s a large .

Alt loan providers are a threat so you can incumbents as they possibly can provide traditional lending products, eg mortgage loans, in order to customers cheaper with relaxed qualification standards. So it along with their scientific products allows alt lenders to add mortgages in a far more attractive ways.

Business solution loan

Applications regarding microbusinesses and you may small businesses are generally denied of the traditional financial institutions. Considering the looser laws and regulations to own alt loan providers, they may be able exploit brand new popular away from small enterprises.

Predicated on a study in the Government Reserve Financial from Richmond, when you look at the 2016 merely 58% regarding loan requests off small enterprises was in fact passed by incumbent banks, compared to 71% approved by alt lenders one to same season.

As opposed to old-fashioned credit, alt lenders have the ability to control a standard number of analysis and server learning – allowing them to come to then toward small company financing sector than incumbent banking institutions.

Fellow-to-Peer (P2P) mortgage

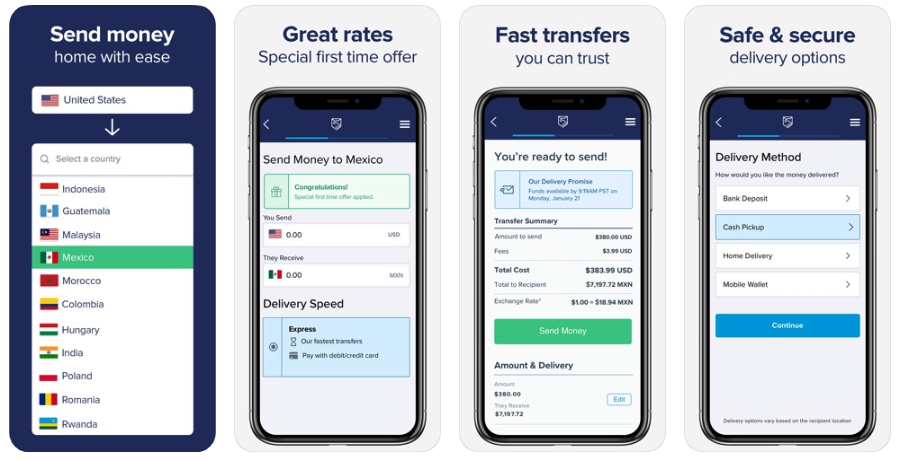

Peer-to-Peer loans perhaps one of the most preferred forms of choice financing assemble a debtor, a trader, and you may a partner bank as a consequence of an internet system. Leveraging metrics, eg credit scores and you may social media passion, P2P systems can be hook up consumers to help you loan providers at compatible interest rates.

P2P lending networks assists connections in place of indeed owning the finance letting them keep can cost you reasonable. So it high quality is very appealing to customers looking to re-finance present loans at reasonable price it is possible to.

Finest nonbank and you can solution lenders

- SoFi: This startup initial worried about student loan refinancing, however, has exploded to incorporate home mortgage refinancing, mortgages, and personal finance. Within the 2019 SoFi signed an excellent $five hundred billion funding bullet provided because of the Qatar Capital Expert – posing a danger in order to incumbent financial institutions.

- Quicken Fund: So it created nonbank is known for its Skyrocket Financial, an online home loan app which will take below ten minutes to done. In Q4 2017, Quicken Finance became the most significant United states home-based home loan founder from the volume – even overcoming away Wells Fargo.

- Kabbage: This is one of the first on the internet lending systems and uses third-team studies to eliminate SMBs distribution wrong guidance. The brand new startup offers organization-to-team operations, along with they shielded $200 billion rotating credit studio shortly after currently acquiring a great $700 mil securitization contract 90 days previous.

- OnDeck: This really is a sensation-let globally financial program helping small- and you can average-measurements of businesses secure prompt, short-term loans up to $250,000 and you can credit lines as much as $100,000. Within the , OnDeck are obtained by Enova to boost the means to access its economic services and products for advertisers and you can consumers.

Solution lending markets

In the event antique finance companies still hold the premier share of the market to possess providers lending, gains enjoys continued in order to slow indicating a heightened interest in alt lending programs. Because of tech using AI and you will host understanding, alt loan providers can efficiently up to speed people.

Considering Insider Intelligence’s SMB Credit Statement, SMBs compensate nearly all of personal market businesses regarding the Us and rehearse sixty% of all professionals in the united states. However, SMBs will often have difficulties when making an application for loans within incumbent banking companies and you may as an alternative look to alternative credit programs.

Because of the big SMB business dimensions, alternative lending companies are arranged to help you threaten to help you incumbent banks, and you will except if antique banking institutions inform the financing practices, alt financing technology could potentially redesign history processes and get an effective higher % of your own full share of the market.