Instructors exactly who ordered utilizing the CalSTRS Teacher Home loan are now able to use the new CalHERO Teacher Loan program so you’re able to re-finance and combine the in the future becoming exploding CalSTRS mortgage and prevent a subway damage waiting to takes place.

The CalSTRS property program are discontinued when you look at the , as stated contained in this statement, because they are incapable of offer more appealing money getting here members(including CalPATH).

It’s time to Re-finance Your own CalSTRS Financial

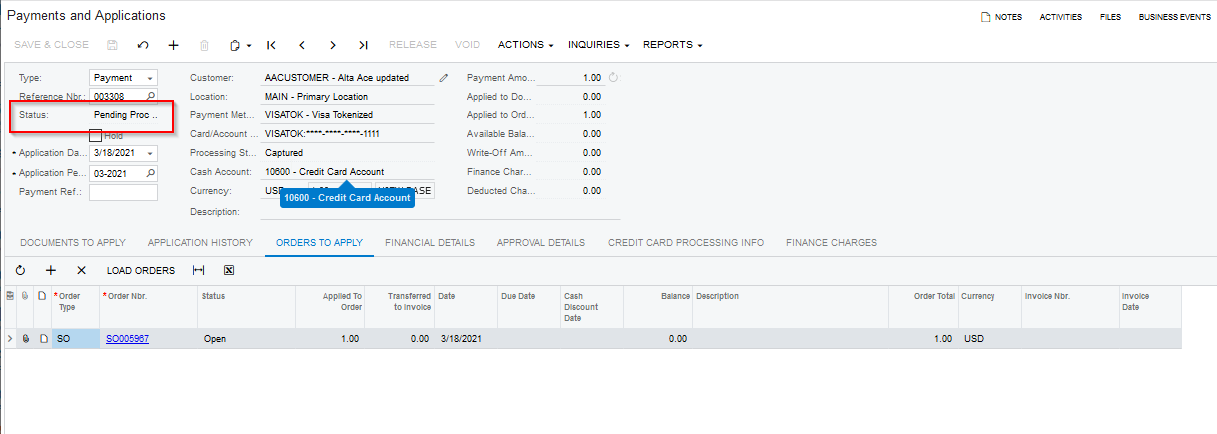

The fresh CalSTRS home buying program try inadvertently create to help you fail right away given that CalSTRS simply certified buyers built 80% of the purchase price, next offered CalSTRS players a deferred interest (zero repayments) next home loan to possess 17% of your own conversion price and you can failed to consider the upcoming amortized commission when determining their ability to repay in the future.

CalSTRS are essentially qualifying individuals for financing they may maybe not manage towards expectations borrowers you will definitely refinance down the road.

Is the CalSTRS Deferred Appeal 2nd Mtg. Similar to a toxic Sleeve Home loan?

The fresh CalSTRS deferred attention 2nd mortgage develops throughout the years, just like a toxic adversely amortizing adjustable rate financial ouch. The pace from which they expands is similar interest rate of first-mortgage. Day-after-day one second financial are deferred they will continue to rating larger.

Another reason the newest CalSTRS next mortgage repayment would be much higher is because the 2nd mortgage payment title is actually amortized over twenty-five decades…..perhaps not 30 years.

Eg: Individuals exactly who sold in often see grows off $250 to $600+ within their complete homeloan payment when they you should never combine the next mortgage on the the CalHERO Teacher Loan system now.

A detail by detail study of one’s chance and you may affordability problems related towards CalSTRS (and CalPERS) home loan programs will likely be read here.

Their CalSTRS next Home loan is Exploding!

When your cost are $325,000, the 17% second home loan harmony try to begin with $55,250. If your interest are 5.75% at that time, your second mortgage commonly put off regarding $step 3,177 off simple appeal from year to year. 5 years later, your current balance can be doing $71,135!!

That $71,135 commonly now be amortized over twenty five years while increasing their fee by the $445/week…..that is a subway ruin would love to takes place if not re-finance.

Earlier Hurdles to Refinancing a CalSTRS Financing

- Guarantee CalSTRS consumers have not had sufficient guarantee so you’re able to combine its 80% first mortgage as well as their 17% deferred attention (now Anaktuvuk Pass loans large) mortgage towards the you to definitely low rate financing at this point.

- The fresh new servicer of your CalSTRS loan could have been hard otherwise will moments unwilling to using the second home loan and permit individuals to help you re-finance the initial home loan. Whenever they did consent, they’d promote CalSTRS players mortgage loan which was much higher than just what it will be, ergo eliminating the advantage of refinancing.

Of a lot CalSTRS consumers skipped on to be able to refinance whenever rates was indeed on their lowest from these several big hurdles.

Are CalHERO your best option in order to Re-finance good CalSTRS Mortgage?

I think its pretty noticeable that draining your deals otherwise old-age account to pay off otherwise pay down another mortgage are perhaps not a wise economic move, however may prefer to check with your CPA or Economic Adviser. In addition to, that has that sort of bucks resting within bank account?

Having fun with an enthusiastic FHA loan so you can refinance good CalSTRS blend financing probably won’t help save you as often currency because of the FHA financial insurance costs.

Brand new Quantity Never Lie

To see if you are qualified and you may/or exactly how much you’ll save by the refinancing their CalSTRS 1st & next home loan into the you to definitely financing and get away from a train ruin, consider the the fresh new CalHERO teacher mortgage and contact me personally otherwise phone call (951) 215-6119.