Wisdom DSCR financing to own services significantly less than $100K is essential having smart people. This type of funds provide customized economic options, leveraging the debt Services Publicity Proportion in order to support property funding despite straight down property philosophy.

Secret gurus were basic qualification processes and higher mortgage constraints, which makes them good for quick-size real estate possibilities. Focusing on how DSCR loans works and prominent play with times can be somewhat improve your funding strategy.

Locating the best financial is essential. Pinpointing secret standards, investigating better loan providers, and you may knowing the character out of brokers can be improve the process. Stay tuned even as we delve into challenges, advantages, and you may tips for maximising DSCR loan approvals.

What exactly Kansas installment loans is good DSCR Mortgage?

A personal debt Service Exposure Ratio (DSCR) loan is a type of mortgage designed especially for a house traders. It assesses this new borrower’s capability to pay the mortgage centered on the bucks disperse made by the leasing property unlike private money. This makes DSCR financing a well-known choice among investors, specifically those having contradictory individual money.

Unlike old-fashioned fund, hence greatly trust a borrower’s loans-to-money ratio, DSCR finance focus on the property’s income possible. It means the more money the home yields, a lot more likely you are so you can qualify for an effective DSCR loan. Essentially, this new DSCR strategies the new property’s web functioning earnings against its personal debt loans.

Therefore, why is DSCR significant? Consider you really have accommodations possessions one to creates big rental income. With a beneficial DSCR financing, the degree of income your house produces gets the key foundation on your own financing acceptance processes, therefore it is extremely useful to own functions which have good income.

DSCR funds are easier to be eligible for than just agency or bank loans and get down interest levels than simply tough currency funds getting investment an investment property.

Its crucial to keep in mind that DSCR loans generally can not be utilized needless to say assets designs such as for instance outlying properties, qualities having lower than 750 square feet, or uncommon formations like dome homes and you can record cabins.

Of unmarried-household members residential renting to help you multifamily qualities, DSCR finance appeal to a general spectrum of investment solutions. Although not, to help you meet the requirements, its essential that money spent yields rental money.

Secret Advantages of DSCR Finance

Why must investors imagine DSCR finance to own qualities less than $100K? The clear answer will be based upon their gurus. An important advantage ‘s the concentrate on the property’s earnings instead than individual financials. This might be such beneficial for notice-operating consumers otherwise those with varying income.

A serious benefit is the fact DSCR financing not one of them W2s or evidence of consistent private earnings, causing them to perfect for experienced people. It concentrate on the property’s internet working earnings lets far more independence in the loan recognition.

- Income-mainly based eligibility: The mortgage recognition will be based upon leasing income, not individual earnings, providing an approach to capital of these having non-conventional earnings provide.

- Prospect of large financing numbers: In the event that a property creates highest local rental earnings, the newest borrower ount, for this reason helping the acquisition off best qualities.

- Rates: When you are higher than antique finance, DSCR funds features all the way down prices compared to the difficult money loans.

How much does this suggest for your requirements since a trader? It indicates a greater likelihood of approval for funds and possibility to purchase functions which can if you don’t feel regarding monetary arrived at. At the same time, DSCR financing often have longer cost terms, making them a lot more manageable.

Even after such positives, it is vital to be aware of the highest rates of interest while the importance of a serious down-payment, always ranging from 20-30%, to satisfy financial standard.

Just how DSCR Finance Work

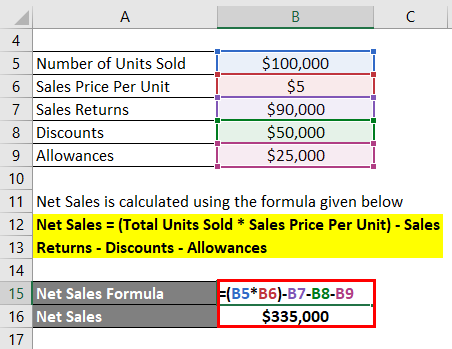

The fresh procedure out-of DSCR loans spins within the ratio alone. The debt Provider Coverage Proportion was calculated because of the splitting the internet doing work income of the house of the their annual debt obligations. Essentially, they methods if a good property’s earnings is enough to coverage the financing payments.