You can invest in stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, and more. SoFi doesn’t charge commissions, but other fees apply (full fee disclosure here). Depending on the industry they were in and the D/E ratio of competitors, this may or may not be a significant difference, but it’s an important perspective to keep in mind. Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom. Researching stocks has never been so easy or insightful as with the ZER Analyst and Snapshot reports. An industry with a larger percentage of Zacks Rank #1’s and #2’s will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4’s and #5’s.

Part 2: Your Current Nest Egg

Total equity, on the other hand, refers to the total amount that investors have invested into the company, plus all its earnings, less it’s liabilities. The energy industry, for example, only recently shifted to a lower debt structure, Graham says. If you’re an equity investor, you should care deeply about a firm’s ability to make debt obligations, because common stockholders are the last to receive payment in the event of a company liquidation. Here’s what you need to know about the debt-to-equity ratio and what it reveals about a company’s capital structure to make better investing decisions.

- The cash ratio provides an estimate of the ability of a company to pay off its short-term debt.

- Sectors requiring heavy capital investment, such as industrials and utilities, generally have higher D/E ratios than service-based industries.

- Therefore, even if such companies have high debt-to-equity ratios, it doesn’t necessarily mean they are risky.

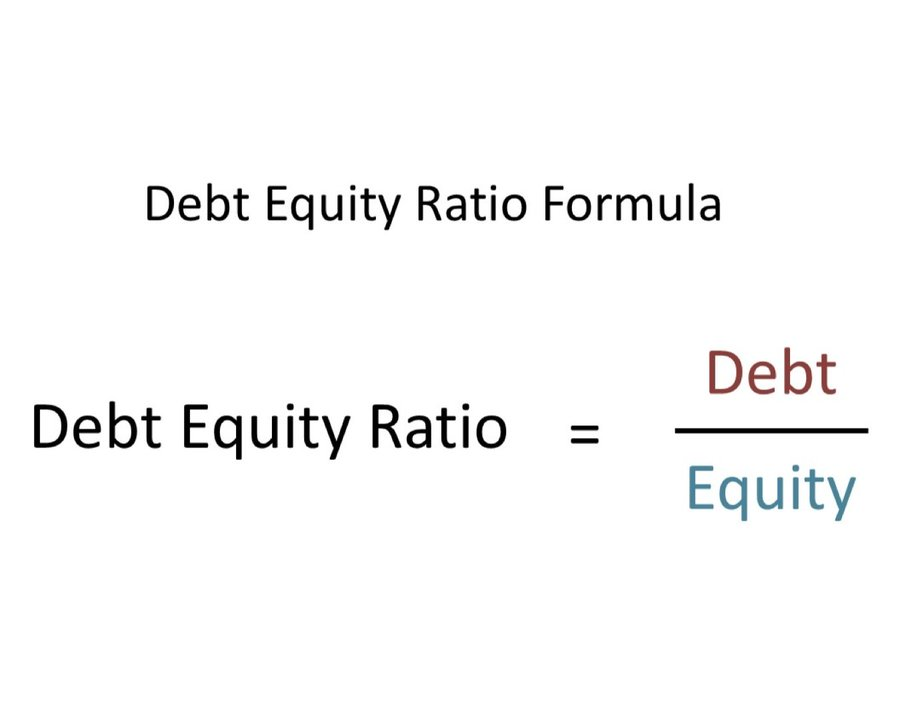

- The D/E ratio represents the proportion of financing that came from creditors (debt) versus shareholders (equity).

- For example, manufacturing companies tend to have a ratio in the range of 2–5.

- Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

How To Calculate Debt To Equity Ratio

The debt capital is given by the lender, who only receives the repayment of capital plus interest. Whereas, equity financing would entail the issuance of new shares to raise capital which dilutes the ownership stake of existing shareholders. Investors who want to take a more hands-on approach to investing, choosing individual stocks, may take a look at the debt-to-equity ratio to help determine whether a company is a risky bet.

Q. What impact does currency have on the debt to equity ratio for multinational companies?

Debt typically has a lower cost of capital compared to equity, mainly because of its seniority in the case of liquidation. Thus, many companies may prefer to use debt over equity for capital financing. In some cases, the debt-to-equity calculation may be limited to include only short-term and long-term debt.

Attributing preferred shares to one or the other is partially a subjective decision but will also take into account the specific features of the preferred shares. Ultimately, the D/E ratio tells us about the company’s approach to balancing risk and reward. A company with a high ratio is taking on more risk for potentially higher rewards. In contrast, a company with a low ratio is more conservative, which might be more suitable for its industry or stage of development. Considering the company’s context and specific circumstances when interpreting this ratio is essential, which brings us to the next question.

Retention of Company Ownership

The debt-to-equity (D/E) ratio is a metric that shows how much debt, relative to equity, a company is using to finance its operations. In our debt-to-equity ratio (D/E) modeling exercise, we’ll forecast a hypothetical company’s balance sheet for five years. In the majority of cases, a negative D/E ratio is considered a risky sign, and the company might be at risk of bankruptcy.

To get a sense of what this means, the figure needs to be placed in context by comparing it to competing companies. The following D/E ratio calculation is for Restoration Hardware (RH) and is based on its 10-K filing for the financial year ending on January 29, 2022. Of note, there is no “ideal” D/E ratio, though investors generally like it to be below about 2.

That’s because share buybacks are usually counted as risk, since they reduce the value of stockholder equity. As a result the equity side of the equation looks smaller and the debt side appears bigger. Not only that, companies with a high debt-to-equity ratio may have a hard time working with other lenders, partners, or even suppliers, who may be afraid they won’t be paid back. As noted above, it’s also important to know which 7 ways to improve your accounts receivable collections type of liabilities you’re concerned about — longer-term debt vs. short-term debt — so that you plug the right numbers into the formula. Other companies that might have higher ratios include those that face little competition and have strong market positions, and regulated companies, like utilities, that investors consider relatively low risk. As a general rule of thumb, a good debt-to-equity ratio will equal about 1.0.

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. This is helpful in analyzing a single company over a period of time and can be used when comparing similar companies.

The Debt to Equity ratio is a financial metric that compares a company’s total debt to its shareholder equity. Including preferred stock as debt can inflate the D/E ratio, making a company appear riskier, whereas counting it as equity would lower the ratio, potentially misrepresenting the company’s financial leverage. This issue is particularly significant in sectors that rely heavily on preferred stock financing, such as real estate investment trusts (REITs). The debt-to-equity ratio (D/E) compares the total debt balance on a company’s balance sheet to the value of its total shareholders’ equity.