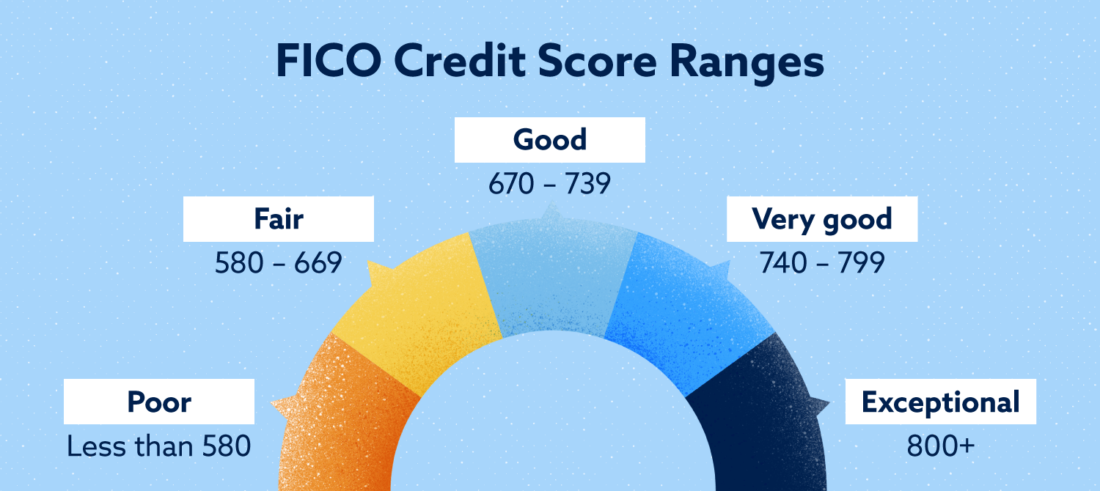

A credit history away from 700 or higher is considered good to own a get ranging from three hundred to 850.On a single measure, a get from 800 or even more can be considered a beneficial.The majority of people have fico scores anywhere between 600 in order to 750.An average FICO Score in the us whats edd card inside 2020 is actually 710, right up 7 circumstances from the past season.Creditors may be a great deal more depend on in your ability to pay future financial obligation should your rating is highest. When looking at customers having fund and you will credit cards, loan providers could possibly get explain their unique requirements for what they regard to be great or bad credit scores.

This might be influenced by the sorts of individuals they might be shopping for.Financial institutions also can think just how newest occurrences make a difference a consumer’s credit history and change their demands accordingly.

Some loan providers build their own credit rating applications, nevertheless FICO and you may VantageScore credit reporting designs would be the very commonly used.

That have a credit rating out of 700, you’ve joined the brand new good borrowing from the bank area, and that means you can buy low interest with the monetary items including fund and handmade cards. On 690, this new good range initiate. A credit score away from 700 is even enough to buy a great home. You may also be able to to track down loan providers prepared to take a look at you to have high-worthy of functions that require jumbo loans.

You could potentially receive the top pricing when you have a score (720 or more). Thankfully you to improving your get doesn’t have so you can be difficult.Listed below are some punctual methods to improve your credit score.

What is the most practical method to improve my personal credit score out of five-hundred to 700?

Read your credit score. One per year, head to annualcreditreport discover a no cost credit report regarding for every single of one’s around three credit agencies (Equifax, Experian, and TransUnion).Pick discrepancies that have a terrible affect your borrowing get or take actions in order to fix all of them. See the new report’s negative facets and try to improve all of them, such as purchasing costs punctually or reducing loans. Be sure to spend your repayments into the schedule.When you have trouble purchasing expense promptly, set up automated costs during your bank’s expenses shell out provider otherwise create age-mail notifications from your credit card business. Pay off people outstanding debts.Paying off a profile have a tendency to enhance your credit rating, however, keep in mind that a financial obligation who has got went to your range look on your credit history to own seven ages.

Catch-up with the one earlier in the day-due costs.If you have fell about into the a repayment, catch up as soon as possible.An overlooked payment can lead to a get reduced amount of upwards to help you 100 points.Which black stain on the credit history usually takes a while to remove, but never disheartenment: your credit score might be considering your most recent facts rather than earlier in the day borrowing trouble.

Keep your credit card balances lowest.To boost your credit rating, a popular principle is always to contain the balance for the each credit line at the or below ten%.A balance which is close to otherwise exceeds the borrowing limit can get an extreme bad influence on your credit rating.

How do i improve my credit score from 600 to help you 700?

Instead of a couple of times moving financial obligation, pay it back. If you are a balance transfer to shell out no interest or a lower interest on your own debt are helpful, be sure to pay the bill first prior to taking towards next debt. According to FICO, perhaps one of the most effective strategies to replace your credit history would be to reduce your overall debt. Do not romantic levels that have been reduced. Closure unused charge card account reduces your credit score by detatching their offered borrowing. Staying them discover and you will underused implies that you really have a good credit score management skills. Also, before you can intimate older charge card levels, remember that with a lengthy credit rating support their credit history.

More a brief period of energy, come across the fresh new borrowing. Lenders commonly eliminate your credit score to find out if your be considered having a mortgage, an auto loan, otherwise a credit card, also to pick the rate they are going to charges. The new FICO rating algorithm often see that you are comparing costs having a single new mortgage or charge card in the place of trying to open numerous the brand new credit lines if you team such programs within a few days otherwise a week. Use many handmade cards. People that have one another repayment loans and you may playing cards is desirable to FICO. Having two handmade cards is even a sensible option if you are paying college loans, keeps an automobile mortgage, otherwise home financing. And now have so many handmade cards could be damaging, you should have one or more to display that you can responsibly manage credit. Get the latest credit only when absolutely necessary. Make an application for the newest borrowing only when you truly need it, not only to enhance your credit limit. Opening a lot of the new credit accounts in the a short period of your energy have a tendency to harm your credit rating.

Sure a single having a great 700 credit history can acquire a beneficial household. 700 try believe becoming a good credit score anytime your financial isnt noticed high-risk you will have no issue getting accepted to purchase property. Contact the advantages during the Ability Home loan Class today to let score you home loan acceptance.