For the simple terms, predatory financing are an unjust behavior that makes it hard for individuals to repay their fund. Usually, predatory credit comes to higher rates of interest, extreme costs, undetectable and undisclosed words, etc. Regarding an interest rate, when a debtor are unable to repay the loan matter, the property is actually foreclosed, or the debtor may even need file case of bankruptcy.

Predatory financing try among the best reasons for having the commercial recession of 2009. Regrettably, predatory financing means have not prevented ever since then. Thus, you need to be an intelligent individual to stop becoming an excellent sufferer out of predatory credit.

Talking about a number of predatory financing signs just be familiar with when you shop otherwise taking out a mortgage.

Financing also provides through the send

You may get financing now offers over the telephone or from the send. But hardly have a tendency to these types of come from reliable lenders. Very, for folks who receive a phone or post render, it would be from an enthusiastic unlicensed bank.

The lending company charges more than step three% costs

Constantly, you have to pay ‘points’ otherwise ‘discount points’ into the lender to take aside financing. Although not, it needs to be in this 3% of one’s complete loan amount. Very, if your lender was charging much more, it is a red-flag.

The loan comes with a higher rate of interest

Watch out for finance that include highest interest levels, particularly about three-fist rates. This is certainly a sure manifestation of predatory credit. It does trap individuals into a period of personal debt, which is hard to emerge from.

Problems contrary to the bank

Exactly as you research reviews prior to purchasing things, check out analysis concerning your financial prior to acquiring financing. Examine on the internet although their lender provides a pleased customer base. Be mindful in the event that there are many complaints because it’s an indicator from predatory decisions.

The loan includes a beneficial prepayment penalty choice

It is better to not ever go for a mortgage with good prepayment punishment. It means you pay a charge if you prefer to repay your loan very early. You’re going to have to spend so it percentage even though you wanted so you can re-finance to possess most useful conditions and terms on your loan.

Such as for instance an option can possibly prevent you from paying back your loan very early, even although you normally. Thus, it does reduce the advantages of refinancing.

The financial institution promises to personalize small print later on by way of refinancing

Remain aware in the event your financial attempts to encourage your one to future refinancing usually solve any difficulty. This will be a method away from predatory credit to sell bad product sales in order to borrowers. It is usually best to go shopping for a loan, evaluate the conditions and terms, and find the most appropriate one that you might do easily over the whole mortgage name.

You should use home loan hand calculators to check out your house mortgage value. As well, prevent frequent refinancing. You pay a great deal more by several times altering from 1 mortgage to a different.

Their lender may not include the price of insurance policies and you may assets fees on your own month-to-month mortgage payments. Listed below are some ahead of time even in the event your own lending company has created an enthusiastic escrow make up this type of inevitable costs. A good predatory lender may want to improve loan profitable of the not including such will set you back into your mortgage repayments.

Later, you will be surprised whether your month-to-month financial money boost. Hence, speak to your bank and get any type of inquiries arrived at your head before deciding.

And work out a bogus declaration on the loan application

Do not make untrue comments on your own mortgage app, it does not matter who implies you do therefore. You should know that giving out completely wrong information about a home loan software is considered fraud. It may tend to be overstating your earnings, not revealing your current expense, etc. You could must deal with criminal punishment.

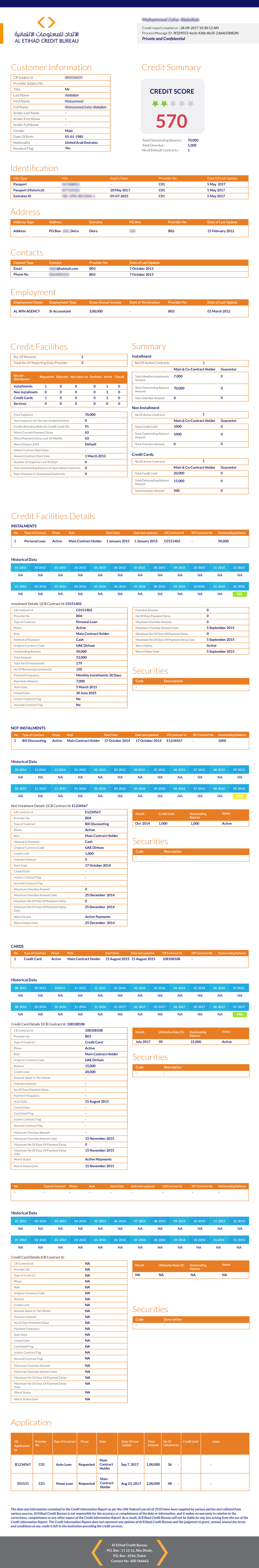

The lending company has the benefit of a loan instead of examining the creditworthiness

It is a sure sign of predatory credit when they never look at your creditworthiness prior to offering you financing. Loan providers always look at your creditworthiness to be sure you are able to repay the mortgage by making on the-go out financing money. A loan provider may request your own bank information to possess a handy automated payment solution.

For individuals who invest in they, the lender may end upwards with your bank account since an Atm. Carry out yourself a benefit and get off that it.

The deal is actually advisable that you end up being correct

Sooner, trust your intuition if you find yourself taking out a home loan and other loan. Be mindful if for example the small print towards the a loan are too good to become correct. Be practical.

Definitely browse the terms and conditions carefully before you can actually choose. You are able to neglect a hidden term if you don’t see meticulously. Do not signal things which you don’t understand.

It will always be far better rating help from a legal professional concentrating for the a residential property laws. They’re able to review the loan contract and you may show you exactly what you’re signing.

If you can’t manage an attorney, you might means an effective HUD-acknowledged counseling company. They can feedback your write-ups and you will refer you to definitely an attorney who can make it easier to free-of-charge otherwise during the a highly reduced costs. In that way, you’ll getting positive that you aren’t a target off predatory lending when you’re buying your dream domestic.

Bio: Lyle Solomon has actually big legal actions sense and you will large hand-into the studies and you will experience with judge investigation and creating. As the 2003, they have already been a person in the official Pub regarding Ca. Into the 1998, he finished throughout the University of the Pacific’s McGeorge School of Law during the Sacramento, California, and today serves as a main lawyer towards the Pine Take a look at Legislation Classification from inside the Rocklin, Ca.